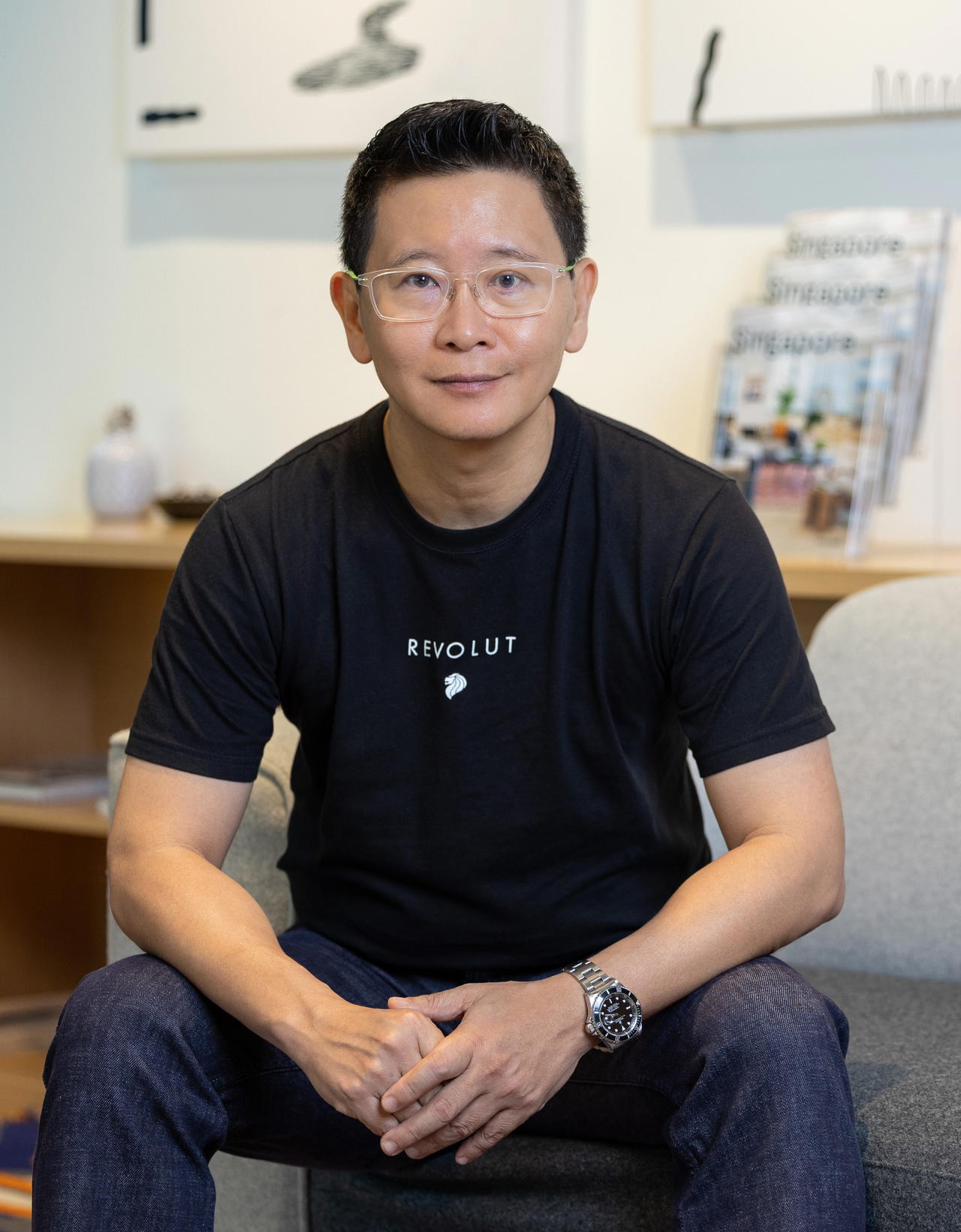

Before taking on my current role as CEO at Revolut Singapore, my career included expansions for global companies, such as Liquid Group, MasterCard, Microsoft, and Visa. You could describe me as a frequent flyer by every standard; my record was up to six trips in a month, sometimes spending less than 24 hours in a city.

I am also a strong advocate of taking personal time off and disconnecting from work. Every year, I spend at least a month travelling, reconnecting with myself and my family, and reflecting on my work. It helps me strategise my next steps. What’s more, It has also been very effective for me in terms of making important decisions.

Although I enjoy travelling, trying new cuisines, and meeting new people, I have always dreaded one pitfall: paying unnecessary foreign transaction (FX) fees. In Singapore, most banks charge up to 3.25 percent per transaction. Not only are such fees hidden, but I also find them unfavourable. This keeps me driven at Revolut, where we offer financial solutions that help others get more out of their money.

More than 45 million people around the world use our hassle-free digital apps to perform more than half a billion transactions every month. Our goal is to empower our customers financially and to seamlessly connect people around the globe.

GOING FURTHER AND STAYING LONGER

Travel demand in Singapore, of course, continues to rise. According to Statista, passengers departing Changi Airport increased by more than 80 percent year-on-year from nearly 16 million to 29 million in 2023.

This is expected to continue this year. According to results from a survey Revolut commissioned with YouGov, one in five Singaporeans believe they will spend more on travel in 2024 than they did in 2023. Even so, we still prefer setting a budget and using tools to make sure that budget is followed.

Meanwhile, here are a few more numbers to consider:

• 54 percent of Singaporeans surveyed determine their travel budget by estimating the costs for transportation, accommodation, and activities

• 47 percent consider the duration of the trip as well as daily expenses; 35 percent consider using available savings or disposable income

• 25 percent set a fixed amount based on previous travel experiences

Travelling involves so many exciting aspects that money is often an afterthought or forgotten altogether. Until, of course, one returns home and tries to frantically figure out how those additional costs were incurred.

48 percent of Singaporeans surveyed use credit cards to pay when they are overseas, with 44 percent relying on dynamic currency conversion. Of these. Gen X makes up 53 percent, and Gen Z, 34 percent.

In most cases, avoiding these costs was possible. In particular, currency exchange fees. Consider this: over 40 percent of Singaporeans surveyed have paid FX fees to their bank or credit card issuer for overseas purchases. And this: More than 30 percent have been charged fees for converting currency, whether by their bank or through currency exchange services.

But that’s not all. Approximately one in four have paid dynamic currency conversion fees abroad when paying in their home currency. The same number also applies to those who paid ATM withdrawal fees from non-partner banks or international ATMs. In other news, nearly 30 percent of Singaporeans surveyed consider themselves value travellers and close to 20 percent enjoy experiential trips. Three out of five also book their accommodation in advance to take advantage of deals.

TIE-BREAKER FOR DEAL SEEKERS

In 2019, Revolut launched in Singapore with a multi-currency card. We wanted to make the experience transparent and to simplify the process.

With Revolut, travellers enjoy budgeting and analytics tools, easy bill splitting when travelling in a group, and very competitive currency exchange rates.

With its Metal plan, they also get discounted lounge access, travel insurance, and cashback of up to 1.5 percent. Most Singaporeans use several methods to exchange currency, with 70 percent preferring to go to a money changer, while 25 percent do it at their destination country. They also utilise currency exchange kiosks or bureaus (12 percent), and withdraw cash from ATMs (13 percent).

Revolut wasn’t just designed to offer users competitive exchange rates, better than what they’d get at a money changer or a bank. They can also spend in over 150 currencies and store up to 34 currencies, including Indonesian rupiah, Philippine peso, Thai baht, and Korean won.

Anyone can open an account from their phone, get a card, and start spending. With this app, you can top up your account and send and receive money, too. A fee-free currency exchange is also available on weekdays for up to $5,000 per month on the Standard Plan.

Travelling becomes safer, too. There’s no need to carry large chunks of cash since you can withdraw up to $350 (Standard Plan) from overseas ATMs each month—fee-free. Users can also find nearby ATMs through the Revolut app. Upon loss or theft, the card is frozen or locked for greater peace of mind.

Among the mobile savvy, digital apps like Revolut for currency exchange gain more traction than among the boomers—37 percent of Zoomers compared with 16 percent of the latter. With four long public weekends in 2025, many Singaporeans are already booking their next holiday. Rather than readjusting your itinerary to fit your budget, it may be more efficient to streamline your budget and eliminate unnecessary costs.

More about Revolut here.