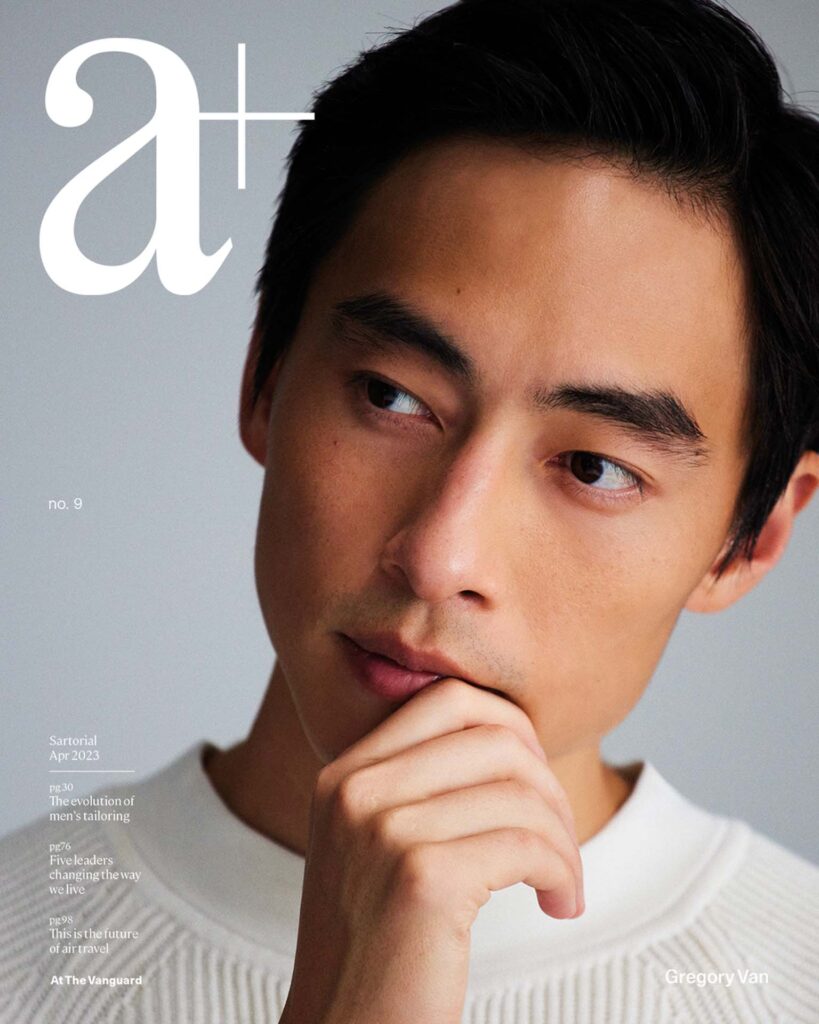

It was Christmas. Gregory Van had taken his eldest daughter out when they came across an Endowus Giving Machine. As part of the company’s charitable initiative, which started in 2021, the vending machines didn’t dispense food or drink, but a Giving Card in denominations of $10, $20 and $30. There were cards for tangible items such as food, therapy sessions, and more that the giver could purchase for beneficiaries to use.

Van explained the mechanics of the machine to his eldest and left it at that. Unexpectedly, the little girl said she wanted to use the money set aside for her Christmas present to buy a Giving Card. “She thought that giving [these cards] to people who needed them was a better use of the money than buying Christmas presents. This was surprising because we hadn’t really taught her the concept of giving yet,” recalls Van.

“Maybe she just liked the lights in the vending machine,” Van continues, laughing. “But jokes aside, I could see the seriousness in her eyes when making her conscious choices.”

The apple doesn’t fall far from the tree. Van is, after all, the charismatic CEO and co-founder of Asia’s leading fee-only digital wealth management platform Endowus, the firm behind the Giving Machines initiative, which has raised over $125,000 for 24 charities.

Van’s daughter didn’t know the rectangular metal box with the pretty lights was an initiative started by her father’s company. She only knew that it helped people in need. That was more than enough for her.

Making Money, Doing Good

Similar goals drove Van when he started Endowus. The former UBS investment banker and ex-Grab senior manager had grown frustrated with the financial industry and its opaque processes. He saw financial advisors hawking products with massive upfront and recurring commissions that might not be right for clients’ lifestyles, and realised the incredible hoops individuals and families had to jump through to build a financial portfolio that fit their needs and goals.

“I’m not talking about a decade here. I’m looking 50 years ahead, and even further. A financial cycle lasts 10 years. I want Endowus to last generations.”

Gregory Van has long-term plans for Endowus

Endowus plugs this gap in the market, offering an intuitive way for users to grow their money as transparently as possible. That’s why it doesn’t take commissions from the financial products it offers on its platform. Instead, it takes only a small advisory charge, which it calls the Endowus Fee, and returns all trailer fees—payments that financial distributors receive for selling a fund to investors—to clients. Van estimates that Endowus has saved its clients over $40 million by returning these trailer fees as cashback, as well as offering institutional share class funds, which from the outset, charge a significantly lower fee as compared to retail share class funds.

Photo: Mun Kong.

“I believe being transparent will lead to informed investment decisions and better client outcomes, which will then lead to unlocking time, life and more positive externalities for people,” says Van. He’s clearly doing something right. Endowus took shape three years ago with zero dollars and a big dream. In that brief span of time, it has grown rapidly, gaining billions of dollars in assets and tens of thousands of clients.

Today, Endowus is the largest digital independent wealth advisor in Singapore and one of the biggest in Asia. Van reports that the company has over US$4 billion (S$5.3 billion) of assets under management and counts Carret Private, a large multi-family office from Hong Kong in its stable. It has raised money externally from the likes of UBS, Singapore’s EDBI, Singtel, Samsung and more, and following early success in Singapore, will soon be launching its digital fund platform in Hong Kong.

Its meteoric rise isn’t by accident. Endowus has diligently expanded its offerings, and has an eye-popping spectrum of investing strategies, from ultra-defensive portfolios and diversified indexes, to hard to access private equity and hedge funds, and some of the best-in-class funds on the market on its platform.

The best endorsement? Even Van’s family invests most of their money with Endowus.

Money Isn’t The Goal

The pursuit of wealth, however, is just a means to an end. For him, money is a tool that gives you the freedom to pursue the issues that matter to you. The sports enthusiast is happiest when he’s with his family and friends, shredding the snowy slopes or hitting the links. In that regard, he wants Endowus to provide the same freedom to his clients.

Some might dismiss Van’s success, pointing to his privileged background. He doesn’t shy away from that fact. In some ways, Endowus’s expansion to Hong Kong is a homecoming of sorts, as that is where his family is originally from. His grandfather came from poverty, a refugee from Shanghai making his way to Hong Kong when he was 18. With his zeal and entrepreneurial spirit, he worked non-stop to build a better life for his family.

Photo: Mun Kong.

Van possessed those same qualities, even if he wasn’t aware of it until much later. “I might actually be the most conventional one among my siblings,” he chuckles. “One brother is in agriculture, another is self-discovering, and my sister is an artist. All of us came out to do our own thing.”

His investment journey began when he was younger. At 14, he interned at HSBC Asset Management in Hong Kong. His job: create spreadsheets. Three years later, he bought Amazon shares and watched eagerly when the stock rose 7 percent in three days. Seeing himself as an investing savant, Van began making bold—some might say foolhardy—trades. His portfolio yo-yoed up and down, and eventually cratered, brought down to earth by the 2008 global financial crisis.

That experience taught him to invest in an evidence-based manner, and he’s brought that philosophy to Endowus. It’s the reason why Van prefers to stick to the public markets, where information is readily available, and refrains from venturing into highly speculative asset classes such as whisky and art. He loves the latter, and he and his wife regularly purchase pieces together. However, art has played a major role in both his best and worst investment decisions.

A while back, he bought a Shara Hughes painting as a gift for his wife and daughter. Within a year, it appreciated 700 percent. He sold it, mainly because he wanted to fund another art purchase, but also thought it was a good time to lock in his gains.

“Within a couple of years, the same painting went up 2,000 percent,” Van says wryly.

Making Better Decisions

With the growing success of his company—it recently clinched the Best Digital Wealth Management honour at Asia Asset Management’s Best of the Best Awards 2023—you’d think that Van would rest easy, but he admits he feels even more pressure now with the added responsibilities.

“When we started in an empty room with just a dream, it was easy and carefree. Now, I am accountable to our stakeholders, clients, employees, and those who have entrusted us with their financial aspirations and backed us from the start,” Van says.

He professes that the pressure is both debilitating and empowering. His vision, which hasn’t wavered since day one, drives him forward. The recent financial tumult hasn’t helped. Ever the rational utilitarian, however, Van and his team ignore the short-term noise of the market and focus on making the right long-term decision. The beauty of Endowus’s fee-based business model allows for this, and Van emphasises that he is in this for the really long haul. “I’m not talking about a decade here. I’m looking 50 years ahead, and even further. A financial cycle lasts 10 years. I want Endowus to last generations.”

Photo: Mun Kong.

He also wants Endowus to be invisible. It’s an odd statement to make, but it’s the perfect reflection of his worldview that making money is just the process, not the goal. “A lot of wasted energy goes into wealth management, and I want to automate this. We’ve achieved our goal of helping our clients invest better and live better when we become invisible.”

His foresight is prescient, considering the increasing chatter of artificial intelligence in mainstream society. In a short period, Open AI’s chatbot tool ChatGPT has gone from writing simple emails to passing rigorous graduate-level law and business exams.

He has studied the technology, but remains sceptical about its usefulness in making investment decisions. “The financial field has welcomed different machine learning models and AI for years. And, in the past 70 years, some of the biggest computers in the world have been used to make money in the markets. However, only a handful of players have experienced some success.”

Van isn’t shying away from AI and recognises that the wave will envelop his field for the better. He believes Endowus will be able to serve more people, and hyper-personalise with the help of technology advancement. Instead of reinventing the wheel and incorporating AI into Endowus’s strategies, he prefers to give his clients access to asset managers that have successfully embedded AI when creating their products.

Endowus already uses AI to facilitate workflows and communication, and will continue using technology to improve their client’s wealth management experience.

The Next Generation

Something Van is really excited about is Endowus’s work with charities and not-for-profit organisations. Several in Singapore have tapped on the platform to manage and grow their treasuries and Van is committed to helping them stretch their dollar so they can spread the wealth around to more beneficiaries. “They operated in a low interest rate environment for a long time and inflation has really hurt their pockets, so I’m glad Endowus can help.” The company is making minimal money from it, but he strongly believes in giving back.

It is for this reason that he’s glad his daughter became excited over the Giving Machine and sacrificed her Christmas money for the community. Still, he suspects that she might have the wrong idea about some other machines.

“My daughter hears me talk a lot about the company on the phone when I’m at home. One day, she asked if she could head to the office with me. I agreed. Then, she said, ‘Is there a machine in your office? A machine that I can give money to so that it can give me more money?’” Van chortles heartily.

Photography: Mun Kong

Styling: Chia Wei Choong

Grooming: Keith Bryant Lee, using Kevin Murphy and Tom Ford Beauty

Photography Assistant: Melvin Leong